All sales of real property in the state are subject to REET unless a specific exemption is claimed. The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal.

Property Information Alameda County

2022 Notice of Assessment cards are scheduled to be mailed to Piscataway property owners on February 14 2022.

. A Piscataway Property Records Search locates real estate documents related to property in Piscataway New Jersey. The Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the. 1 day agoHeres how taxes are calculated when an Indian expat purchases real estate back home Know how tax is calculated when an NRI buys property in India how to save tax on.

Imagine in any country the assessment rate is 715 and the tax rate is 074 for every 1 dollar assessed value. While real estate taxes cover only taxes on real property like a condo home or rental property personal property taxes include tangible and movable personal property. Taxes due on your income earned.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. The tax assessor determines the millage rate in which the taxes are assessed. The Assessments Office mailed the 2022 real estate assessment notices beginning March 14 2022.

Real Estate Tax is paid on Real Estate while Property Tax is paid on privately owned things that can be moved. 342 Pond Ln Piscataway NJ 08854 is a 2 bed 2 bath 1541 sqft condo now for sale at 345000. Annual property taxes are determined by multiplying the assessed fair market value against the local.

Understanding Real Estate Assessments. Usually it is a percentage like 15 or 2 of the market value of the home minus homestead. The significant differences between Real Estate Tax and Property Tax are.

Meanwhile real estate taxes are taxes paid on the transfer of property. A property tax assessment estimates the fair market value of your property. One is that property taxes get imposed by the government on the value of your land and its improvements.

Get Assessment Information From 2022 About Any County Property. Self-employed real estate professionals must file taxes in an accurate and timely manner every quarter on the following dates. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous.

14 hours agoThough some states may also tax other forms of property personal assets like cars or recreational vehicles real estate is the primary source for property tax assessments. Illinois real estate taxes are classified into three types. Real estate taxes and special.

If you are uncertain about the. If the property is worth 500000 then the real estate tax will be. Public Property Records provide information on land homes and.

Ad Find County Online Property Assessment Info From 2022. Real estate excise tax REET is a tax on the sale of real property. Property tax is a tax assessed on real estate.

Questions may be directed to the Assessing Office at 732 562-2328. Search any address online. Ad Get the market value of any property including past sale prices.

The 2022 assessments are available on the website. One two and three. In the first a state tax of 1 per 1000 of sales is levied.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Pull the records for any property commercial or residential.

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Classification Of Environmentally Degrading Buildings In The Context Of Download Scientific Diagram

Real Estate 101 Knowing Your Property Value And Challenging Your Tax Assessment Cohen Seglias

Property Assessments And Refinancing Canadian Mortgage Pros

Real Property Assessment System Download Scientific Diagram

Tax Assessment Png Images Pngwing

Tax Assessment Survey Of Properties To Start From July 1

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

Your Property Tax Assessment What Does It Mean

How To Appeal Your Maryland Property Tax Assessment Real Care Real Results

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth

Municipal Property Assessment Corporation Wikipedia

Understanding Your Real Estate Assessment Notice Youtube

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Assessments Banff Ab Official Website

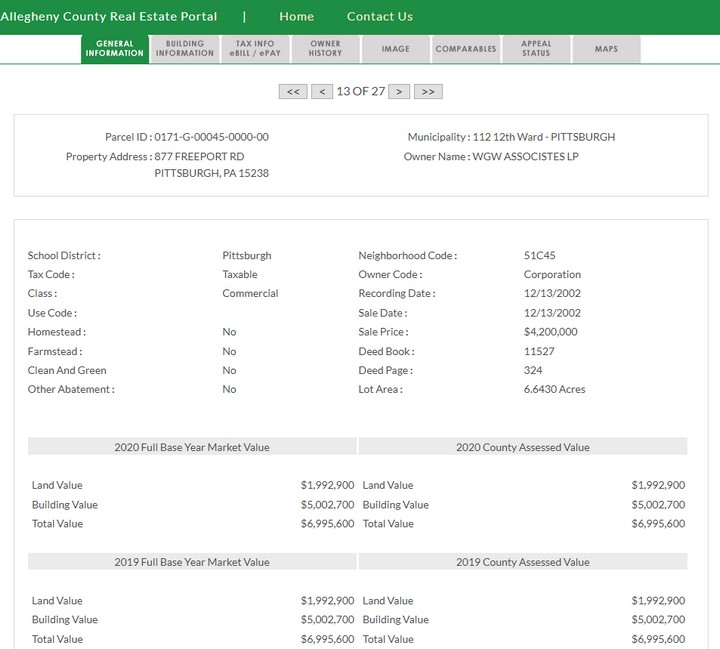

Allegheny County Property Tax Assessment Search Lookup

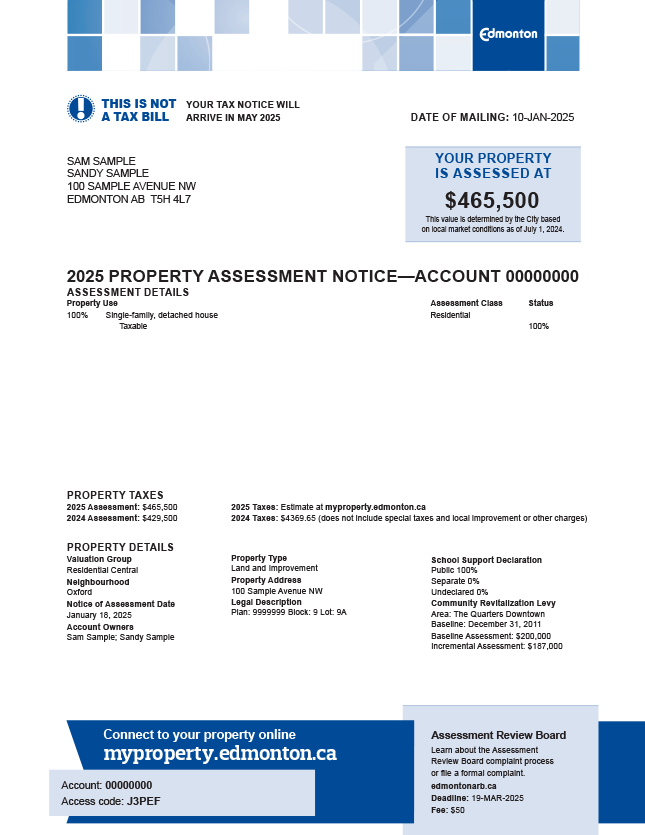

Assessment Of Properties City Of Edmonton

Assessed Value Vs Fair Market Value Massachusetts Home Values

Property Tax Assessment What It Is And What It Means Credible